Reminiscences of a Startup Operator: Part 1 - Finding Sick Unicorns

My journey with a startup from zero to one, a playbook on becoming a strategic thinker and executor, and what good feels like.

Foreword

After 2 years at EigenLayer, I'm officially parting ways with the company and will be exploring something new.

I am starting a Substack and will write about my journeys and learnings from being with this unicorn. And will continue to publish articles on startups, VC, career and life.

EigenLayer (a marketplace for verifiable compute) contributed to some of the best two years in my 20s, or arguably, in my current life.

I was alongside the journey where Eigen grew from close to zero to the peak of $20B in assets deposited, and from a low hundred million valuation to a full $10B. I saw it expand from a small academic team of 10, with a business strategy team of 3, to the full expansion of Labs & Foundation at 120+.

To wrap up this journey, here is the first part of my story: how I discovered this unicorn early on and some mental heuristics that might be helpful to others who are interested in finding and joining high potential early projects.

Note: this three-part series is dense—it's a condensed version of a 2-year journey. Skim for the big ideas, or revisit when you need the details. Gratitude to Sreeram, CL, Owen & Skyler for feedback on this piece.

The Beginning: Find the Right Problem to Solve

Lesson 1: Expose yourself to the mountain to find the unicorn

It was 2022 when I first entered the industry. I joined a VC fund where my daily mandate was brutal but enlightening: scan 30-40 crypto projects every day to surface 5 interesting ones. Nearly a thousand each month.

This volume did something unexpected—it trained my pattern recognition. Like feeding massive datasets to an AI, I could instantly spot novel ideas versus recycled ones.

Most people underestimate how much exposure you need before developing real judgment.

During my conference circuit journey, I saw a professor named Sreeram Kannan presenting at the first Modular Summit in Devconnect Amsterdam (hosted by Celestia in 2022). Having been "big data trained," Layr Labs immediately stood out as an interesting project—a professor project that even I had never heard of. These were generally big in unicorn potential (look at what people at IC3 have accomplished).

How to apply this heuristic:

Pattern recognition requires volume. Most people form opinions after seeing 5 examples: they're often wrong.

New industry: Read 10 pieces including reports, articles and books (if there is any). Write things down.

Finding mentors: DM 30 relevant people. Only 5 will have thoughtful observations. You can't identify them without talking to the other 25.

Company hunting: Study 50 companies to find 5 worth joining. Then convince them to create a role for you. Look for the right company and not a job. If you're applying to posted jobs, you're already too late.

The mental razor: You need 100 data points to have one good opinion.

Lesson 2: When high-signal people whisper about something no one understands, pay attention.

Back in the 2023 bear market, everyone I knew was Ethereum-centric. I spent 2 months in Zuzalu Montenegro with the Ethereum community at Zuzalu. The conversations were predictable: ZK, MEV, onchain games, and longevity.

But I was independently researching restaking—something fundamentally tied to Ethereum that somehow only attracted a few high-signal people like Dankrad, Tim Beiko, and Justin Drake. The smartest people in the room were intrigued but couldn't fully explain it. That gap was the opportunity.

Here's what surprised me: after only a week of research, I was raising questions in the booklet that stumped people who'd been in Ethereum for years. Not because I was smarter—but because I was looking where they weren't. When you can become a relative expert that quickly, you've found a real gap.

How to apply this heuristic:

Smart people being confused is alpha. When three brilliant people say "I don't get X but it seems important," that's your cue.

Examples:

Your CEO mentions the same unsolved problem three times → own it

Top VCs say "interesting but confusing" → dig in

Professors call something "fascinating but understudied" → future Nobel Prize territory

The 2-week test: If you can become the room expert in 2 weeks or less, you've found a gap.

The mental razor: Confusion at the top means opportunity at the bottom.

Lesson 3: Look for the complete package—intellectual attraction, high ceiling, high baseline, and be early.

After digging deep, I realized EigenLayer had all the ingredients for massive success:

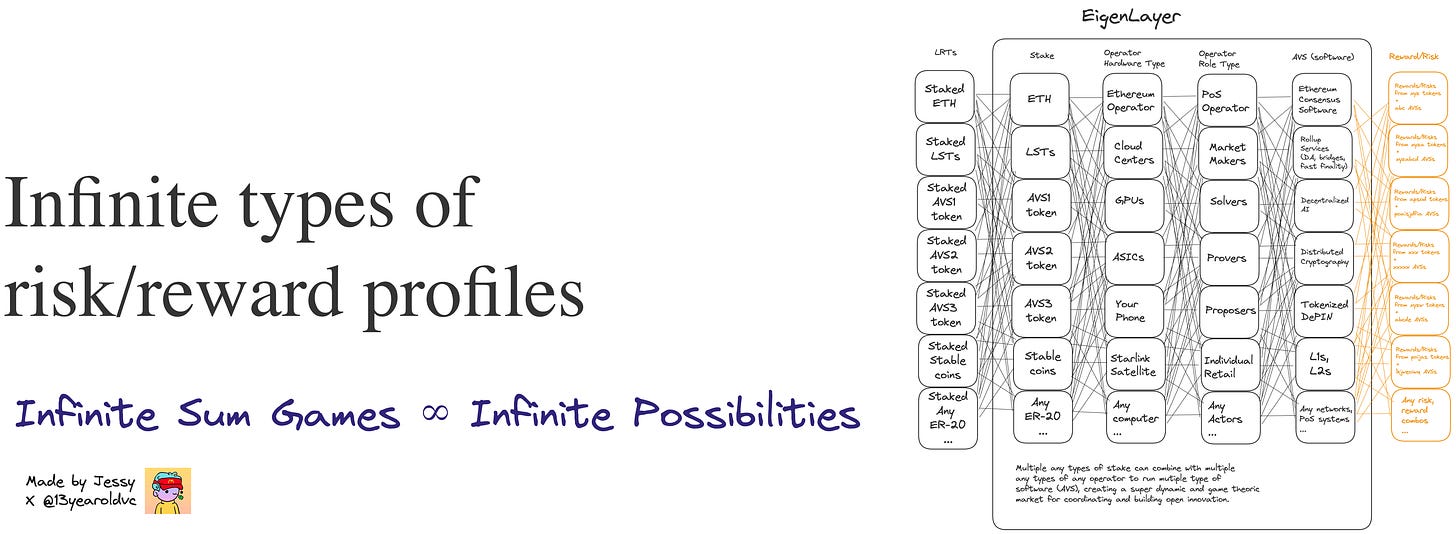

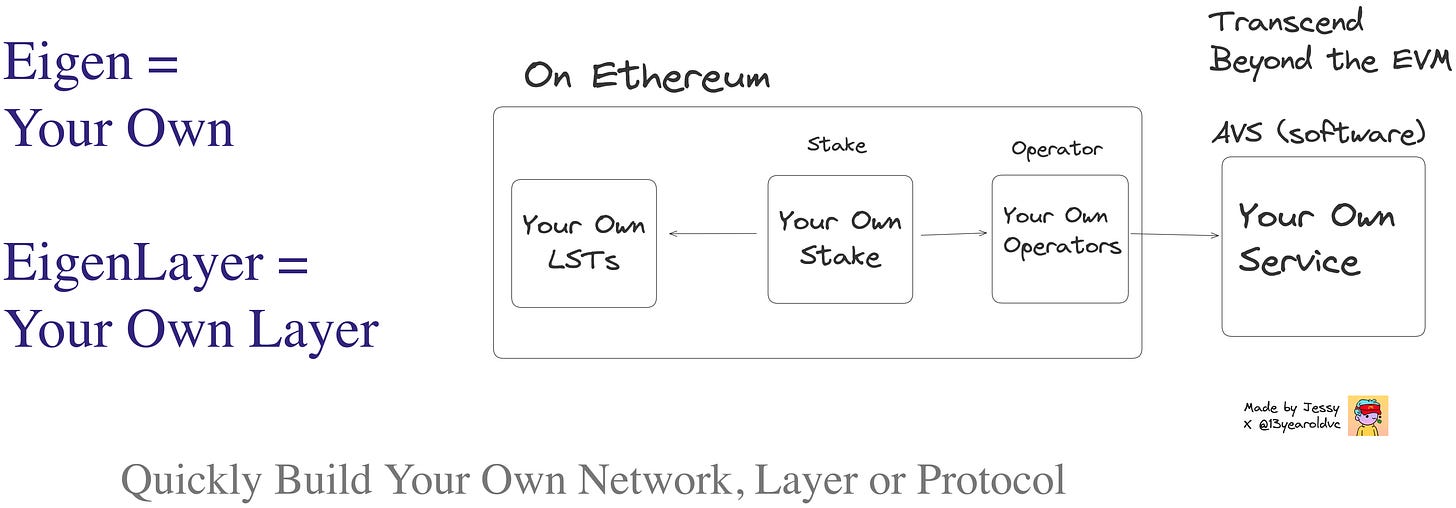

Intellectually fascinating without being inaccessible:

The idea itself is building a game-theoretic marketplace for coordination - which naturally involves complex multi-party dynamics and shifting incentives. You could earn a PhD studying any single aspect, yet it didn't require the advanced mathematical knowledge that ZK did. Smart generalists could contribute immediately

High ceiling: If other projects were playgrounds for launching random memes and apps, Eigen would be the natural incubator for large protocols (naturally big according to fat protocol thesis), which automatically creates a high ceiling as the mother project.

Think of it like this: Ethereum validators power Ethereum, Eigen asks the question could they power other protocols just as large… or supercharge that protocol to be 100x bigger.

Built-in distribution engine to reach that potential: The financialized aspects of the product (i.e., restaking) weren't just features—they were the fuel for adoption. Innovation without distribution dies. Innovation with built-in financial incentives spreads like wildfire.

High baseline with a charismatic founder and solid PhD lab: Sreeram was that rare academic who could nerdsnipe you while keeping things comprehensible. I consumed 10+ hours of his content without fatigue. His early a16z presentation wasn't just good—it was category-defining. When founders can articulate vision this clearly, they attract both capital and talent effortlessly.

Perfect timing for impact: With only 20 people total and 3 in business strategy, the surface area for individual contribution was massive.

Looking back, the real bull market winners are built during bear market obscurity. In 2023, while everyone debated abstractions, three projects were quietly building: EigenLayer, Hyperliquid, and Ethena. None were "hot" then. All became definitive later.

The pattern? Bull markets reward novel, financial driven concepts as momentum from liquidity rushes in. Bear markets reward fundamental innovation. The rare projects with both define entire cycles.

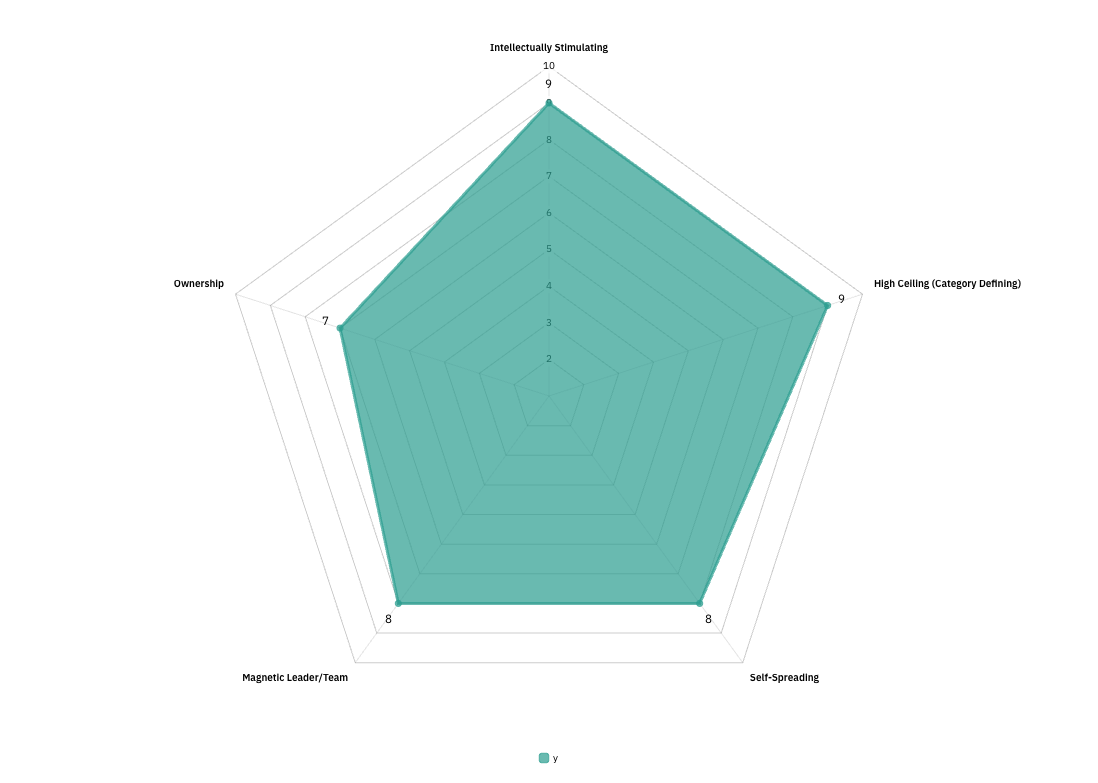

How to apply this heuristic:

Score opportunities on five dimensions (each /10):

Will it rewire your brain? (Corporate job: 2, Yet another early stage startup: 6, Eureka moment: 9)

Can it be 100x bigger? (Feature: 2, Marketplace: 7, Category-Defining: 10)

Does it spread itself? (Needs a lot of convincing: 3, The inevitable / has network effects: 9)

Can the leader recruit legends? (First-timer: 3, Magnetic founder or successful serial founder: 9)

Will you own outcomes? (Employee #1000: 1, Employee #10: 9)

35+ = Life changing 25-34 = Good job <25 = Paycheck

The mental razor: If it doesn't score 25+, you're just paying rent.

Lesson 4: Create dots of goodwill—they become lines when opportunity arrives.

My entry to EigenLayer started with a cold DM to their new CSO on Twitter. He politely declined—they weren't hiring until he figured out strategy and structure.

When he reached out months later with a take-home test, I went all in. Within a week, I'd interviewed 11 potential partners and generated first-hand insights for the take-home, despite minimal public information. I cared a lot, and it showed.

But the real advantage came from the dots I'd been placing for over a year:

Tweeting about restaking when no one cared

Bumping into them at SBC 2022 and then hosting the team at our EthSF 2022 hacker house

Joining relevant community podcasts

Having thoughtful exchanges with core contributors

Each interaction was a small deposit of goodwill. When the moment came, those dots formed a clear line straight into the team. After cycles of exploring identity, onchain games, and ZK with other projects, I knew this was the opportunity I'd been searching for.

How to apply this heuristic:

Tweet about their product

Send them customers

Host their team at your event or hold meaningful discussions

Fix their docs & make open source contributions

The best story I know: An investor mentored some MIT kids for fun. They built Cursor. He got to be their earliest seed investor.

The mental razor: Make deposits before you need withdrawals.

See these pieces that profoundly shaped my approach:

James Clear - Systems, Not Goals

Mark Suster - Lines, Not Dots

The journey continues in the Part 2 post: The Playbook to Build from 0 to 1, and 100

Disclaimer — Personal Views and Informational Content Only

Personal Experience and Views: This content describes my personal experience and learnings during my time in the industry. Views expressed are entirely personal and do not represent the views, strategies, or positions of my former employer or any other organization. This content does not contain company confidential information.

Metrics and Data: All metrics, figures, and growth data mentioned are approximations based on publicly available information, industry observations, and general market knowledge. Specific numbers should be considered illustrative rather than precise measurements.

Strategic Frameworks: Any strategic frameworks, methodologies, or business concepts described represent general business principles and widely-used industry practices, not proprietary information. These are common frameworks applicable across various organizations and industries.

Professional Advice: The content reflects my personal opinions at the time of writing and does not constitute financial, investment, legal, accounting, business strategy, or other professional advice and should not be relied upon as such. I am not a licensed financial-services professional, and no fiduciary relationship is created by your use of this material.

General Information: Do your own research and, where appropriate, consult qualified advisers who can take your individual circumstances into account. All information is presented "as is" without warranties of any kind. I make no representation regarding accuracy, completeness, or timeliness of any content.

Liability: You alone are responsible for any actions you take (or choose not to take) based on what you read here, and you agree that I am not liable for any losses or damages arising from reliance on this content. External links are provided for convenience and do not imply endorsement.

Past Performance: Past performance, whether personal or organizational, is not indicative of future results.

Amazing post!! Thank you for sharing your own personal framework publicly